AI Document Management for Auto Loan Applications

AI-Powered Document Automation

When customers apply for auto loans at dealerships, they must submit a range of documents—W-2s, pay stubs, bank statements, IDs, and even handwritten notes. These files arrive through fragmented channels: email, WhatsApp, SMS, and in-person uploads. Formats vary from PDFs and scanned images to mobile photos.

For credit processors, this creates a major bottleneck. Staff must manually collect, transcribe, and interpret each document before submitting the loan application—slowing down approvals and reducing throughput.

The Stratto Solution

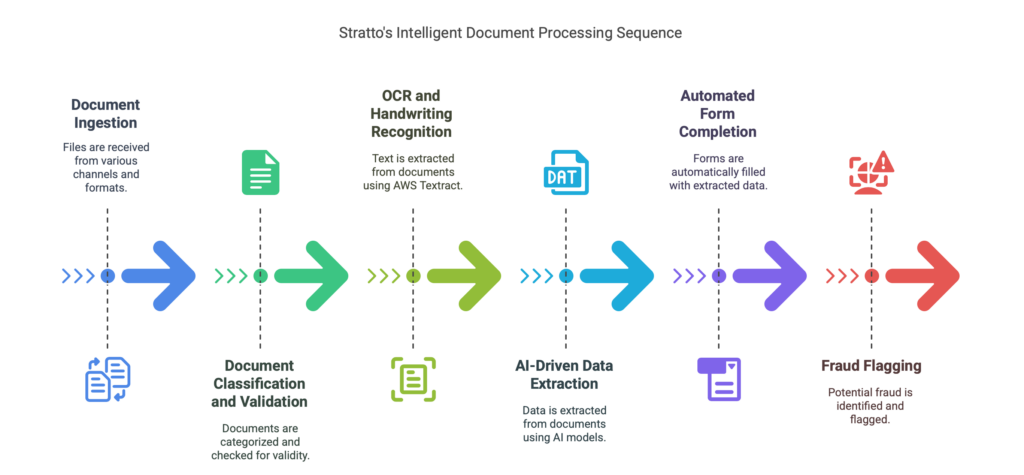

Stratto deploys an intelligent document processing agent, built on AWS and integrated with leading GenAI models (OpenAI, Anthropic, Meta, and others). The solution ingests files from multiple channels and formats—including photos and handwritten forms—and performs:

- Document classification and validation

- OCR and handwriting recognition using AWS Textract

- AI-driven data extraction for credit application fields • Automated form completion and submission.

After processing, Stratto delivers:

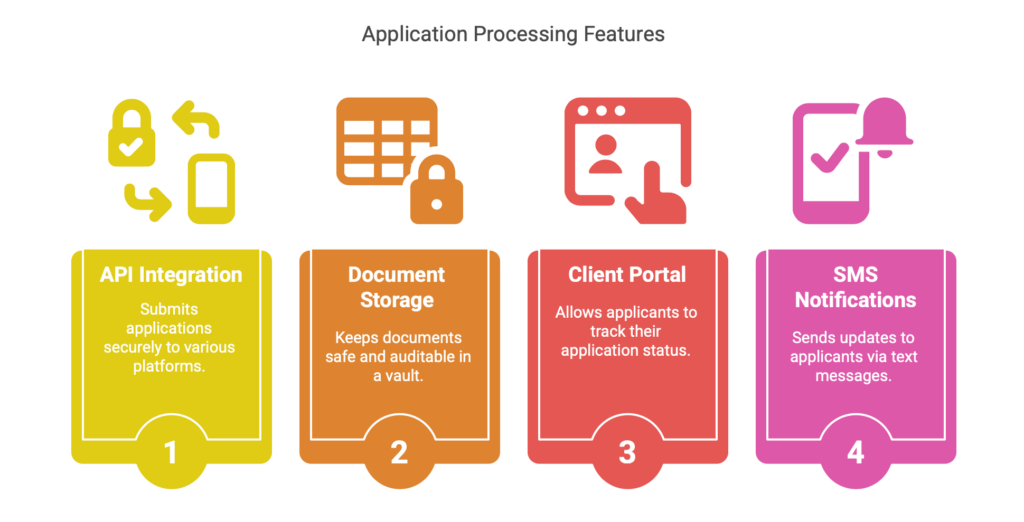

API submission of completed applications to financial institutions, CRM systems, or dealership backends

Secure encrypted storage in a compliant vault for auditability, forensic access, and document retention

A client portal where applicants can track their application status, view documents, and receive SMS updates

Compliance Built-in

Stratto’s solution is architected on AWS PCI DSS-compliant infrastructure, supporting:

Secure transmission and encryption of sensitive data (PII/financial info)

Role-based access control and audit logging

Retention policies that meet federal lending regulations (e.g., CFPB, GLBA, and FTC Safeguards Rule)

This ensures that every document and interaction meets the standards of financial data privacy, security, and traceability.

AI Fraud Detection

By analyzing document inconsistencies, metadata, and behavioral patterns, Stratto’s agents automatically flag:

-

Suspicious income-to-debt ratios

-

Mismatched IDs or altered documents

-

Duplicate applications or reuse of falsified records

This has resulted in a 40% reduction in fraud exposure, giving lenders greater confidence in every submission.

Business Impact

0 %

Improved Accuracy

0 %

Reduced Time

0 X

Increased Productivity

0 %

PCI-DSS | GLBA | Fraud Reduction

-

Full compliance with PCI DSS and financial regulations

Talk to Our AI Experts Today

Discover how Stratto can streamline your auto finance operations.

What they Said

“Our document processing was complicated. Clients sent their documents in multiple formats—from photos to handwritten notes—using every possible channel. Before Stratto, one loan application could take hours. Now it’s done in minutes, and our credit team’s productivity has increased fourfold.”

— Operations Director, Regional Auto Finance Firm